The complete front-office solution for the pricing, hedging and analysis of convertible securities. It consists of four components: a data model of terms and conditions, a pricing engine, an analysis and simulation front-end and an excel screening tool.

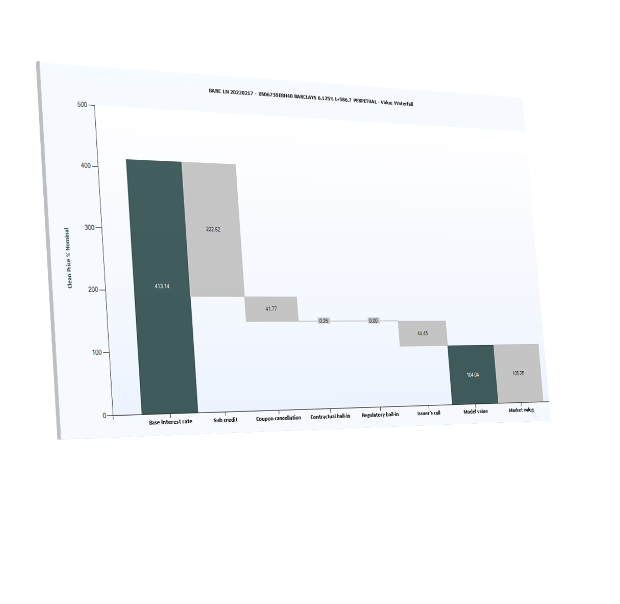

CoCo33 is a pricing and risk management framework for regulatory capital securities issued by banks and insurance companies. It relies on a powerful reduced form regime switching model with stochastic bail-in intensities and stochastic credit, jointly calibrated on the market quotes of the subordinated instruments of the issuer. It analyses the extension risk by assessing the propensity of an issuer to call a security early in a suboptimal way.

The variance swap is an equity derivative with payoff the realized variance of the underlying equity or index. Equity-to-Credit is the new form of volatility arbitrage. Credit risk (through the probability of the underlying equity jumping to zero) adds a component to option premium that cannot be financed by the usual rebalancing of the delta hedge issuing from the Black-Scholes-Merton model